Implementing Global Best Practices in Tourism Taxation & Funding

While customised for New Zealand, many of these ideas could be equally applied to other nations, states, provinces and cities around the world.

- Access “Funding for Tomorrow”, a summary of 10 international best practices in tourism taxation and funding from two major studies across both North America and Europe.

- Read the two-part blog on “Reimagining New Zealand Tourism: Eight Essential Ways to Build Back Better”

Like many parts of the world, Aotearoa (New Zealand) is looking to a better future for its tourism industry post pandemic. To build back better, to renew a tourism industry which is more sustainable, better managed and offers deeper and broader based benefits to the country. A foundation of this renewal, however, will be adequate funding from tourism, specifically the right mix of visitor taxation, levies and other funding sources.

There are clear best practices from across the globe to learn from. In 2020, Miles Partnership helped facilitate (with other agency and industry partners) two of the largest ever studies into tourism taxation and funding options and opportunities. These two major studies looked at North America and Europe respectively and are collectively called “Funding for Tomorrow” (see detailed links below). This exhaustive review of visitor taxation and fees across thousands of destinations provides a great starting point to develop taxation and funding that is “future-focused,” in short; “Funding for Tomorrow”.

As a starting point to the debate in New Zealand (and many other destinations around the world), here are eight initial recommendations for action on sustainable, resilient and regenerative tourism taxation and funding.

1. Tourism Improvement District – A “Future-Focused” Funding Model. The Tourism Improvement District (TID) model emerged from our research as the best option for managing tourism taxation and funding models in a focused, well-governed and transparent structure. Bed taxes, one of the oldest and most common visitor funding models in the world has also been proposed in New Zealand, for example in Queenstown. However, bed taxes are a blunt funding mechanism – dated and fraught with challenges. Chief amongst them is a lack of a dedicated funding structure which allows the vast majority of bed taxes in many destinations to be siphoned off to non-tourism-related spending by governments. This is essentially “taxation without representation” and is a global challenge with tourism taxation of all types. New Zealand should develop a TID model adapted to its needs that reflects the global best practices we identified including dedicated funding, the ability to target a broader range of visitor related businesses (vs. just commercial accommodation) with an independent governance structure that reflects the range of critical tourism stakeholders – local government, industry, residents, Iwi etc.

- References: See more on Tourism Improvement Districts in the “Funding Futures” report – “Evolution of Dedicated Funding” on page 80.

- Civitas, one of our partner agencies in the funding research has additional research and case studies on TIDs and has organized a first ever “Tourism Improvement District Conference” for DMOs, Governments etc. Learn more here.

2. National Legislative Framework/Best Practices: Regardless of the funding model(s) adopted, a consistent and best practice approach to their implementation and management is helpful across nations or states and provinces. We advocate that New Zealand should develop a national legislative framework for the implementation of taxation and funding by Local Government Authorities. This could apply to how Tourism Improvement Districts are established and how specific sectors, i.e. Short Term Rentals (STRs), are managed and taxed (TIDs can and should include holiday and vacation rentals). While allowing some customisation for local issues, this umbrella enabling legislation should provide clear guidelines for when tourism taxation and fees can be activated, how funds can be used, appropriate governance structures and mechanisms for ensuring transparency on the funds raised and where money is spent for the benefit of visitors, residents and businesses.

Memphis Tourism in Tennessee, USA had a robust reserve policy in place ensuring it was well resourced to meet and manage the impact of the pandemic.

3. Reserves & Resilience Funding. Any taxation and funding model should include specific mechanisms to build resilience and manage the elevated risks of a post pandemic world. Importantly this includes building substantive reserve funds; up to one year’s operating budget that can be tapped in the event of future pandemics, natural disasters or other significant interruptions to tourism. Tourism taxation in the future can also be one part of funding the critical need for investment in resilient infrastructure including improved water and waste systems and projects to minimize and mitigate the impacts of climate change, for example expanding renewable energy or improved flood control projects.

- References: See more on Reserves in the “Funding Futures” report – “Building Reserves” on page 67. Also, see the ‘Tourism Taxes by Design’ European report – “What Taxes?” and “Mapping Taxes” on pages 11 and 17 for funding examples of infrastructure & resilience projects.

4. Risk Mitigation. Another element of a resilient future is solving the crisis in insurance especially for major events, conferences and cross border travel. The COVID-19 crisis has brought into sharp relief the risks of events being cancelled and borders being closed at a few days or even hours, notice. These pandemic related risks (eg: event cancellations and border closures) are now excluded by ‘Force Majeure’ clauses in almost all insurance policies. A national public–private insurance model is urgently needed to mitigate this uncertainty and risk during the recovery from COVID-19. See the national scheme Germany has introduced – with other nations eg: the UK, other European countries soon to follow.

- References: See more on public-private insurance is covered in “Sharing Risk” on page 70 in the “Funding Futures” report in addition to an example of how Germany is handling it.

5. National Accord for Central Industry Resources. Though tourism funding from national VAT/GST taxes collected from visitors does occur in a number of countries, the Government has flagged this is unlikely in New Zealand. However, it is important for the Government to acknowledge the significant taxation generated from tourism, including the $2+ billion in GST paid each year by international visitors pre pandemic. Tourism in many nations including New Zealand is the only ‘export’ industry to pay VAT/GST taxes. We advocate a national accord between the tourism industry and the Government that recognises this anomaly and funds critical industry resources that need substantive funding. This long term, cross party agreement can support critical industry resources such as tourism research & data sets, destination management support services, industry skills & capability building and a significant fund for nationally important infrastructure projects. Any such accord should be responsive to tourism growth ensuring national resources are calibrated to changes in tourism activity and therefore, the demands of managing tourism.

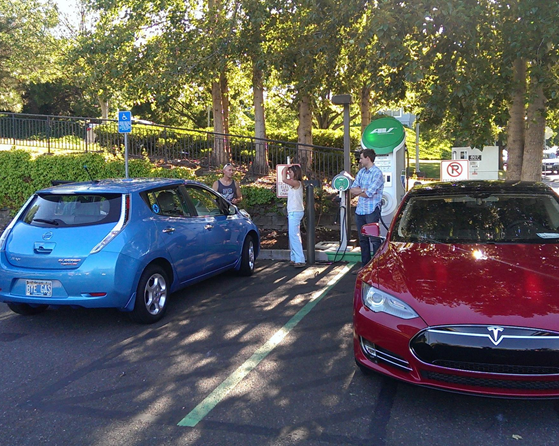

Targeted tourism taxation such as Rental car levies can fund our industry’s migration to electric vehicles.

6. Regenerative – Climate Change Funding. A key feature of “building back better” is ensuring specific funding for regenerative tourism projects – both national and regional. This concept has been embraced by many in New Zealand tourism including a number of Regional Tourism Offices (RTOs) working with international regenerative tourism leader, Anna Pollock, the Tourism Futures Taskforce (see their interim report here) and business commentator Rob Oram (see his recent article here).

Regenerative tourism looks to reinvest in community and/or environmental projects that enhance the destination that both residents and visitors enjoy. Regenerative tourism can also invest in meeting climate change related goals for tourism. In New Zealand this was recently highlighted by both the Climate Change Commission and Parliamentary Commissioner for the Environment. Here are two ideas building on their work: i. A special rental car tax to fund the addition of charging stations across New Zealand touring routes and the rapid migration of the rental vehicle fleet to electric and ii. An airport departure/arrival tax on all international airline flights to fund the migration to biofuels or electric aircraft and/or to offset the carbon emissions while this migration is underway.

- References: See more on Regenerative Tourism Funding on page 87 in the “Funding Futures“. Plus see the ‘Tourism Taxes by Design’ European report – What Taxes? & Mapping Taxes, Pages 11 & 17 for regenerative tourism projects.

- Also see my blog on “Net Zero to New Zealand” from Earth Day 2019.

A wide range of European destinations including Amsterdam in the Netherlands have created visitor taxes that vary by season, length of stay or other ‘outcome based’ objectives.

7. Outcome Based Pricing. Taxes and visitor levies through TIDs, airport departure/arrival tax and rental car taxes should be variable based on demand and supply – moving up or down by seasonality, and even by region. Far higher in peak season(s) or congested ‘hot spots’, far lower in the off season or less visited regions. This type of ‘regulatory design’ of taxes grew significantly in recent years with a range of European destinations such as the Netherlands, Switzerland and Croatia implementing visitor taxes varying by season, region and length of stay. Such ‘outcome based pricing’ sends clear signals to the visitor market on when to visit and that a destination like New Zealand is serious about creating a year round, widely dispersed and well managed tourism industry.

References: See ‘Tourism Taxes by Design’ European report – What Taxes? & Mapping Taxes for details of regulatory design of visitor taxation and levies across Europe plus for more on Outcome Based Funding Models on page 95 of the ‘Funding Futures” report.

8. Long Term Research & Measurement. Finally, New Zealand needs a sophisticated set of research and data tools to measure the performance of any tourism taxation and funding framework that is developed. This would assess results in implementing these taxes against the stated best practices – would update and inform stakeholders and would help review and refine each funding mechanisms based on real world outcomes. This should include undertaking far more thorough ‘foundation research’ – for example assessing the impact of taxation on visitor demand and analysing the full costs vs. benefits of tourism in New Zealand including the value of different types and mix of visitors.

- References: See a global high level review of the fuller costs of tourism ‘The Hidden Burden of Tourism’ (2019, Cornell University) and the ‘The Impact of Taxes on the Competitiveness of European Tourism’ (2017, PwC). The ‘Tourism Taxes by Design’ European report looked at 6 studies assessing the impact of tourism taxes on visitor demand and found at most such taxes have to have minimal impact – though more research is needed.

Final Note: Funding and taxation recommendations need to be reviewed and refined in consultation with all key stakeholders – whether in New Zealand or your destination. This includes consultation with central and local government, the various sectors of the tourism industry, with iwi and across communities. Some targeted research and analysis will likely be needed to inform this process. Strong consultation – supported by good quality analysis and research will ensure tourism taxation when implemented, is well designed and broadly supported.

Tourism needs adequate, sustainable and resilient funding. And this funding is needed now. Urgent action on tourism taxation and funding is urgently needed – both in New Zealand – and many other destinations around the world to ensure our industry can both recover quickly and “build back better”.

Additional Resources:

- Funding for Tomorrow – Access the webinar and executive summary of the two reports including 10 international best practices here.

- Blog on “Funding for Tomorrow” – “10 international best practices in tourism taxation and funding from two major studies across both North America and Europe”

- Funding Futures – North American study report – See an overview here and download the overall report or report sections.

- Tourism Taxes by Design – European study report – download full report here

- Reimagining New Zealand Tourism – Two Part Blog: “Eight Essential Ways to Build Back Better”